/NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES./

(All financial figures in US Dollars unless otherwise stated)

MELBOURNE, June 26, 2017 /CNW/ - OceanaGold Corporation (TSX/ASX: OGC) (the "Company") is pleased to provide an update on its global exploration program across its assets in the Unites States, New Zealand and the Philippines. This exploration update follows the update provided to the market on 30 March 2016 ("March update") and results herein reflect drilling completed after this date.

Key Highlights

- Significant intercepts returned at Haile from the Palomino and Snake targets including:

- Palomino: 96.3m @ 3.11 g/t Au including 16.7m @ 9.06 g/t Au

- Snake: 18.3m @ 4.37 g/t Au and 27.9m @ 1.56 g/t Au

- Continued exploration success at Waihi from underground and surface drilling yielding significant intercepts including:

- Correnso: 4.2m @ 9.01 g/t Au and 5.7m @ 6.22 g/t Au

- Christina: 1.9m @ 9.40 g/t Au and 2.4m @ 9.08 g/t Au

- Gladstone: 40.2m @ 1.46 g/t Au, 13.3m @ 2.45 g/t Au and 14.6m @ 1.77 g/t Au

- Silverton: 6.9m @ 12.97 g/t Au and 5.4m @ 10.11 g/t Au

- Rex: 1.8m @ 16.0 g/t Au

- Significant widths and grade intersected in drilling at Macraes including:

- Coronation North: 22.0m @ 2.40 g/t Au and 5.9m @ 3.45 g/t Au

- Golden Point: 7.9m @ 10.02 g/t Au

- Significant infill drill intercepts from Didipio including:

- Didipio: 120.0m @ 3.2 g/t Au and 0.7% Cu, 123.0m @ 2.2 g/t Au and 0.5% Cu, and 92.0m @ 3.6 g/t Au and 0.5% Cu

- Signed a definitive exploration and option Agreement with Mirasol Resources on 18 May 2017 to explore their 100% owned, La Curva gold project, located in Santa Cruz Province, Argentina.

Mick Wilkes, President and CEO of OceanaGold said, "The latest exploration results continue to demonstrate the exciting organic growth potential that exists at each of our assets. The results at Palomino and Snake at our Haile mine presents a significant opportunity at depth for further incremental resource growth, not included in the upgraded resources we recently announced following the completion of the Haile Optimisation Study." He added, "In New Zealand, our objective is to demonstrate 10+ year mine life extensions for both Waihi and Macraes and continuing positive exploration results, such as what we continue to see, gives us confidence in achieving this objective."

"We will continue our exploration programs to further prove up resources and work with all stakeholders to advance these opportunities through the project life cycle. These organic growth opportunities not only create value for shareholders, but all stakeholders in the regions we operate, as we are a major employer and significant contributor to local economies."

The United States

Haile

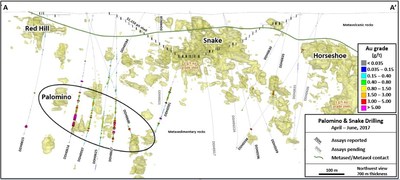

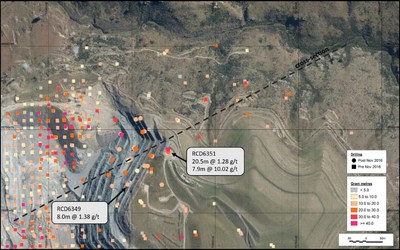

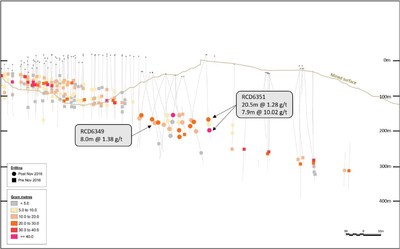

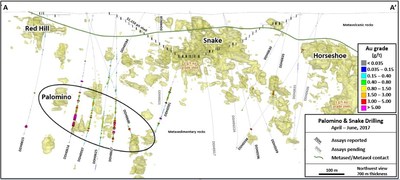

The Company has drilled 35 diamond drill holes for a total of 16,957 metres year to date utilising four diamond drill rigs. Drilling has focussed on the kilometre-long Palomino-Snake-Horseshoe corridor, including advanced drilling of the Palomino target and the continuity of higher grade mineralisation below the Snake pit, adjacent to the Horseshoe underground resource.

The Company completed 14 diamond drill holes for a total of 7,306 metres on the Palomino and Snake targets since the March press release, with assays for five holes pending (Figure 1). The drilling intersected significant mineralisation (Table 1) at both the Palomino and Snake targets, approximately 800 metres apart, at depths ranging between 250 and 350 metres (Figure 2). Geologic logging and modelling confirmed northeast plunging, lozenge-shaped zones of disseminated gold mineralisation hosted in strongly foliated, silicified and pyritic metasediments along the southeast-dipping limb of the Haile anticlinorium

A high-grade zone has been identified at Palomino currently measuring approximately 100 metres long by 70 metres wide and 30 metres thick. The limits of mineralisation are currently defined by a drill hole spacing of 40 to 70 metres. A preliminary resource estimate will be undertaken in the third quarter to assess economic viability of the Palomino deposit and the need for further drilling.

The Company continues to advance regional exploration activities within several priority targets around the Haile mine. Initial drilling of the Holly target has commenced and geophysical and geochemical data are being evaluated to advance other targets scheduled for drilling in the fourth quarter of 2017.

Table 1 – Significant Drill Intersections from Palomino and Snake Drilling

|

Drill Hole ID |

Project |

East (m) |

North (m) |

Collar (m) |

Depth (m) |

Az |

Dip |

From (m) |

To (m) |

Width (m) |

Gold (g/t) |

|

DDH0591 |

Snake |

542919.6 |

3826831.4 |

136.2 |

703.6 |

178 |

-59 |

339.9 |

395.9 |

56.1 |

0.75 |

|

511.6 |

526.5 |

14.9 |

0.92 | ||||||||

|

DDH0594 |

Palomino |

542989.4 |

3826432.0 |

155.4 |

493.0 |

221 |

-58 |

319.3 |

331.4 |

12.2 |

1.02 |

|

DDH0597 |

Palomino |

542970.8 |

3826079.7 |

155.8 |

599.2 |

333 |

-54 |

409.7 |

425.5 |

15.8 |

2.8 |

|

466.7 |

479.2 |

12.5 |

1.81 | ||||||||

|

494.1 |

532.0 |

37.9 |

1.08 | ||||||||

|

DDH0598 |

Snake |

543426.0 |

3826990.2 |

155.4 |

733.3 |

177 |

-51 |

184.7 |

203.0 |

18.3 |

4.37 |

|

DDH0600 |

Palomino |

542970.8 |

3826079.7 |

155.8 |

621.1 |

359 |

-65 |

502.2 |

553.4 |

51.2 |

0.70 |

|

541.8 |

551.0 |

9.1 |

1.90 | ||||||||

|

DDH0615 |

Palomino |

542519.3 |

3826368.6 |

145.4 |

602.4 |

146 |

-51 |

546.1 |

555.2 |

9.1 |

6.72 |

|

DDH0616 |

Palomino |

542740.0 |

3826383.0 |

151.0 |

565.9 |

164 |

-69 |

341.8 |

376.9 |

35.1 |

1.30 |

|

Including |

387.2 |

483.5 |

96.3 |

3.11 | |||||||

|

433.3 |

450.0 |

16.7 |

9.06 | ||||||||

|

DDH0625 |

Palomino |

542711.0 |

3826556.0 |

136.0 |

715.3 |

154 |

-63 |

254.1 |

268.7 |

14.6 |

0.95 |

|

448.6 |

469.9 |

21.3 |

0.69 | ||||||||

|

479.1 |

497.3 |

18.3 |

0.75 | ||||||||

|

DDH0627 |

Palomino |

542711.0 |

3826556.0 |

136.0 |

654.4 |

139 |

-56 |

440.9 |

477.6 |

36.7 |

0.86 |

|

500.2 |

565.7 |

65.5 |

1.94 | ||||||||

|

574.0 |

588.1 |

14.1 |

2.64 | ||||||||

|

602.6 |

619.3 |

16.8 |

1.40 | ||||||||

|

DDH0630 |

Snake |

543189.0 |

3827068.0 |

149.0 |

562.5 |

175 |

-45 |

425.4 |

434.0 |

8.6 |

1.03 |

|

DDH0635 |

Snake |

543189.0 |

3827068.0 |

149.0 |

535.4 |

159 |

-45 |

449.6 |

477.5 |

27.9 |

1.56 |

|

Note: true thicknesses average 75% of reported interval length based on core intersection angles. |

New Zealand

Waihi

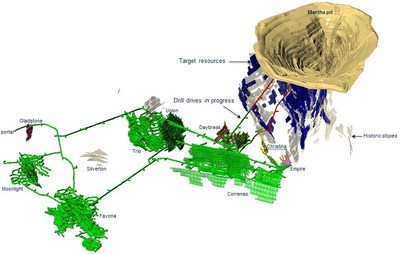

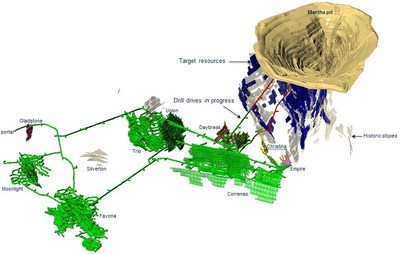

The Company has drilled 93 holes for a total of 18,134 metres year to date, utilising three underground and up to five surface drill rigs. Drilling continues to intersect good widths and grades across multiple targets, adding incremental resource ounces on vein extensions to those currently being mined at Correnso, Empire, Christina and Daybreak (Figure 3).

The Company continues to progress the Martha Project exploration drill drives. The 920-metre drive is nearly 40% complete while the 820-metre drive is nearly 75% complete to the initial drill drive locations. Drilling of approximately 12,000 metres is scheduled to commence in the third quarter of 2017. Favona and Gladstone drilling continues to return encouraging intercepts (Figure 3).

The Company has also commenced drilling on the Rex vein, a splay off the Royal vein, and the historically mined Silverton vein, adjacent to Favona. Both targets have returned significant intercepts that warrant further drill testing. Tables 2 and 3 present significant results received since the March update.

Table 2 – Significant Intersections from Waihi Resource Drilling

|

Drill Hole ID |

Vein |

East# (m) |

North# (m) |

Collar (m) |

Az# |

Dip |

From (m) |

To (m) |

True (m) |

Gold (g/t) |

Silver |

|

807ER1042 |

Christina |

396413.9 |

643321.6 |

806.7 |

270.7 |

-5.4 |

138.6 |

140.3 |

1.1 |

11.34 |

14.2 |

|

807ER1046 |

Christina |

396414.0 |

643321.9 |

808.2 |

280.2 |

27.5 |

77.0 |

81.0 |

1.9 |

9.40 |

10.8 |

|

912ER1037 |

Christina |

396425.1 |

643297.0 |

913.5 |

314.7 |

-17.6 |

85.8 |

86.8 |

1.0 |

15.12 |

10.2 |

|

108.8 |

111.6 |

2.4 |

9.08 |

7.6 | |||||||

|

807ER1042 |

Christina |

396413.9 |

643321.6 |

806.7 |

270.7 |

-5.4 |

157.2 |

160.8 |

2.7 |

5.01 |

12.0 |

|

813CR1034 |

Correnso |

396426.6 |

643539.5 |

810.7 |

97.8 |

-39.4 |

141.6 |

149.1 |

4.2 |

9.01 |

27.9 |

|

813CR1038 |

Correnso |

396426.5 |

643541.3 |

810.3 |

50.6 |

-40.5 |

172.0 |

179.0 |

5.7 |

6.22 |

29.5 |

|

813CR1054 |

Correnso |

396427.0 |

643540.6 |

810.2 |

72.7 |

-37.2 |

142.3 |

155.5 |

6.6 |

4.95 |

21.0 |

|

UW528 |

Favona |

397515.9 |

643150.1 |

1110.6 |

287.7 |

-43.1 |

84.8 |

93.8 |

8.5 |

1.22 |

8.2 |

|

152.8 |

185.3 |

26.6 |

1.69 |

7.1 | |||||||

|

UW532 |

Favona |

397406.9 |

643190.1 |

1125.2 |

284.1 |

-45 |

36.1 |

44.5 |

6.6 |

1.37 |

6.4 |

|

45.7 |

48.2 |

2.5 |

2.46 |

5.0 | |||||||

|

UW540 |

Gladstone |

396922.7 |

642280.8 |

1134.3 |

290.9 |

-45.3 |

82.0 |

86.4 |

4.3 |

1.67 |

3.6 |

|

89.9 |

95.5 |

4.8 |

1.11 |

4.1 | |||||||

|

UW542 |

Gladstone |

396924.5 |

642318.9 |

1133.7 |

307.8 |

-52.7 |

55.00 |

72.8 |

14.6 |

1.77 |

3.7 |

|

87.3 |

92.0 |

4.1 |

1.26 |

8.3 | |||||||

|

UW543 |

Gladstone |

396926.5 |

642321.3 |

1134.0 |

354.4 |

-49.7 |

52.8 |

70.0 |

17.2* |

1.02 |

4.2 |

|

UW544 |

Gladstone |

396923.5 |

642281.3 |

1134.4 |

307.0 |

-44.9 |

107.0 |

120.5 |

11.2 |

1.00 |

7.6 |

|

UW549 |

Gladstone |

396926.4 |

642321.1 |

1133.5 |

22.5 |

-43 |

68.7 |

77.2 |

8.5* |

1.21 |

2.0 |

|

94.4 |

113.3 |

15.5 |

1.00 |

4.8 | |||||||

|

UW550 |

Gladstone |

396924.5 |

642281.8 |

1134.5 |

323.0 |

-42.7 |

74.9 |

115.1 |

40.2* |

1.46 |

4.8 |

|

UW554 |

Gladstone |

396947.8 |

642363.9 |

1142.8 |

13.3 |

-41.4 |

50.0 |

69.9 |

15.2 |

1.23 |

3.1 |

|

UW556 |

Gladstone |

397060.3 |

642327.6 |

1134.2 |

345.0 |

-46 |

55.2 |

61.3 |

6.0 |

2.81 |

15.5 |

|

83.7 |

99.1 |

13.3 |

2.45 |

6.7 | |||||||

|

UW534 |

Silverton |

397060.1 |

642923.8 |

1125.4 |

56.4 |

-45.7 |

49.5 |

52.8 |

2.1 |

20.00 |

67.1 |

|

UW538 |

Silverton |

397040.0 |

642930.6 |

1122.1 |

15.6 |

-44.9 |

63.7 |

68.6 |

2.9 |

5.14 |

15.5 |

|

UW547 |

Silverton |

397070.4 |

642805.0 |

1117.8 |

76.7 |

-50.8 |

64.9 |

73.5 |

6.9 |

12.97 |

22.2 |

|

UW548 |

Silverton |

397095.3 |

642820.6 |

1124.5 |

98.6 |

-43.4 |

24.0 |

28.9 |

3.9 |

31.90 |

27.3 |

|

UW552 |

Silverton |

397091.3 |

642872.1 |

1130.6 |

109.8 |

-49 |

19.9 |

27.0 |

5.4 |

10.11 |

24.0 |

|

UW555 |

Silverton |

397094.6 |

642875.2 |

1130.7 |

32.0 |

-46.4 |

11.6 |

13.5 |

1.6 |

12.76 |

18.7 |

|

# old Mt Eden Coordinate system |

|

* downhole length as not possible to determine true width |

Table 3 – Significant Intersections from Waihi Exploration Drilling

|

Drill Hole ID |

Vein |

East# (m) |

North# (m) |

Collar (m) |

Az# |

Dip |

From (m) |

To (m) |

True (m) |

Gold (g/t) |

Silver |

|

UW539 |

Rex HW |

395382.5 |

642689.4 |

1129.7 |

119.1 |

-21.8 |

77.2 |

77.9 |

0.4 |

9.40 |

152.0 |

|

96.2 |

96.6 |

0.3 |

12.60 |

40.1 | |||||||

|

112.6 |

113.1 |

0.5 |

16.20 |

14.3 | |||||||

|

UW539 |

Rex |

395382.5 |

642689.4 |

1129.7 |

119.1 |

-21.8 |

321.3 |

323.7 |

1.8 |

16.00 |

25.8 |

|

# old Mt Eden Coordinate system |

|

* downhole length as not possible to determine true width |

Macraes

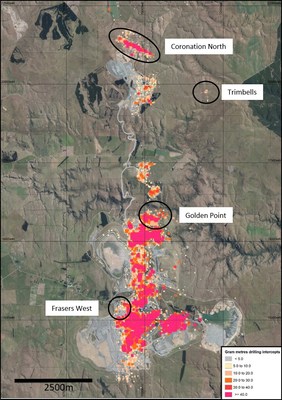

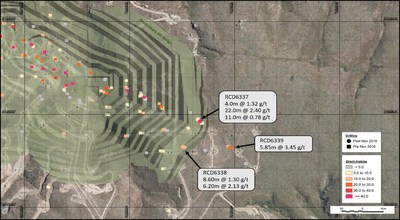

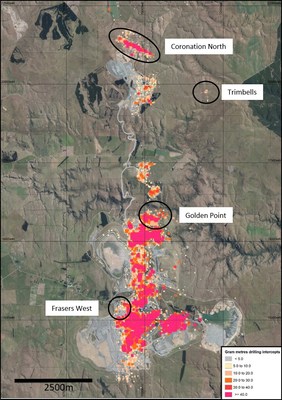

The Company has drilled approximately 2,000 metres of diamond drill holes and approximately 8,700 metres of reverse circulation drill holes year to date utilising one underground drill rig and two surface drill rigs.

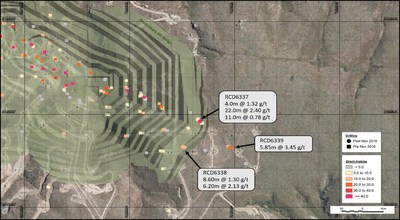

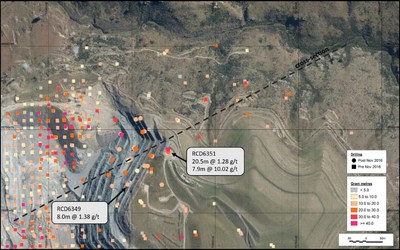

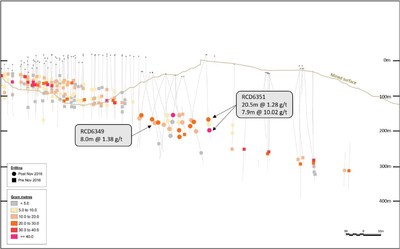

Drilling has focused on the Golden Point, Coronation North, Trimbells and Frasers West targets (Figure 4). Drilling at Coronation North and Golden Point successfully intercepted down plunge extensions to known mineralisation (Table 4, Figures 5, 6, 7) and remain open at depth. Frasers West drilling highlighted the potential of the area to contain a modest bulk, low-grade resource with a low ore to waste ratio, close to existing haul roads and the processing plant. Drilling at Trimbells closed off the target with no further drilling planned.

Table 4 – Significant Intersections from Coronation North

|

Drill Hole ID |

Project |

East# (m) |

North# (m) |

Collar (m) |

Az# |

Dip |

From (m) |

To (m) |

True (m) |

Gold (g/t) |

|

RCD6337 |

Coronation North |

70196.6 |

20953.2 |

637.6 |

314 |

-79 |

185.0 |

189.0 |

4.0** |

1.32 |

|

200.0 |

222.0 |

22.0** |

2.40* | |||||||

|

230.0 |

241.0 |

11.0** |

0.78 | |||||||

|

RCD6338 |

Coronation North |

70150.1 |

20898.7 |

644.8 |

300 |

-81 |

152.4 |

161.0 |

8.6** |

1.30 |

|

163.0 |

169.2 |

6.2** |

2.13 | |||||||

|

RCD6339 |

Coronation North |

70257.2 |

20896.7 |

640.6 |

307 |

-82 |

175.2 |

181.0 |

5.9** |

3.45 |

|

RCD6349 |

Golden Point |

70204.8 |

15571.4 |

430.9 |

067 |

-76 |

140.0 |

148.0 |

8.0 |

1.38 |

|

RCD6351 |

Golden Point |

70367.0 |

15656.3 |

478.9 |

342 |

-81 |

181.7 |

201.7 |

20.1 |

1.28 |

|

216.3 |

224.2 |

7.9 |

10.02* | |||||||

|

# Macraes Gold Project Grid |

|

* Assays cut to 15g/t |

|

** True widths not available |

Philippines

Didipio

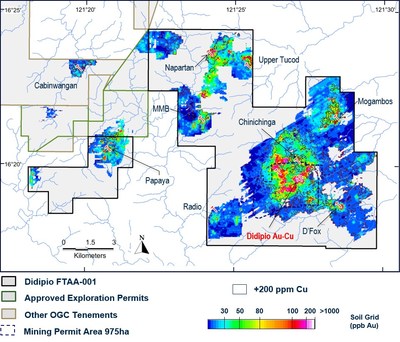

Didipio underground infill drilling continued with 28 holes commenced or completed for 5,407 metres since the March update. All holes intersected mineralisation (Table 5).

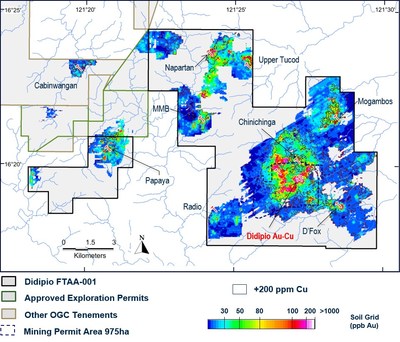

Exploration continues within the broader FTAA (Figure 8) area with detailed surface mapping and sampling at the D'Fox, Chinichinga, Napartan (part of TNN), and Radio prospects. Drill targets have been identified on the D'Fox, prospect aimed at testing the northern down plunge extension of mineralisation identified in previous drilling.

At Chinichinga, surface mapping revealed exposures of monzonite and quartz-monzosyenite porphyry, similar to that of the Didipio deposit. Follow-up of coincident Au-Cu in soil anomalies at Napartan identified Au-Cu mineralised pegmatitic dykes also being of similar composition to those characterising the Didipio deposit. Both locations will undergo further detailed mapping to understand the significance of these results.

Recent geological mapping and soil sampling of the Radio prospect has identified widespread, steeply dipping, E-NE striking auriferous quartz veins and breccias coincident with anomalous Cu and Au in soils. Further field work is required to better understand the distribution and significance of these veins.

Table 5 – Significant Intersections from Didipio Infill Drilling

|

Drill Hole ID |

East# (m) |

North# (m) |

Collar RL (m) |

Az# |

Dip |

From (m) |

To (m) |

True (m) |

Gold (g/t) |

Copper (%) |

|

RDUG001 |

334656.1 |

1805628.7 |

428.2 |

44.0 |

-4.0 |

52.0 |

172.0 |

120.0 |

3.2 |

0.7 |

|

RDUG002 |

334656.0 |

1805628.6 |

428.0 |

44.0 |

-16.0 |

57.0 |

185.0 |

123.0 |

2.2 |

0.5 |

|

RDUG007 |

334613.2 |

1805698.8 |

429.3 |

45.0 |

-25.0 |

22.0 |

49.0 |

24.0 |

1.2 |

0.3 |

|

99.5 |

151.0 |

47.0 |

3.4 |

0.5 | ||||||

|

RDUG008 |

334642.1 |

1805642.8 |

428.5 |

45.3 |

-6.0 |

44.0 |

124.0 |

80.0 |

2.2 |

0.4 |

|

RDUG009 |

334612.6 |

1805699.8 |

430.2 |

31.1 |

-0.5 |

44.0 |

80.9 |

37.0 |

3.6 |

0.6 |

|

RDUG010 |

334612.5 |

1805699.7 |

429.6 |

31.0 |

-16.0 |

15.0 |

84.0 |

66.0 |

2.3 |

0.5 |

|

RDUG011 |

334642.1 |

1805642.8 |

428.0 |

45.3 |

-18.0 |

16.0 |

74.0 |

55.0 |

1.4 |

0.3 |

|

87.0 |

180.0 |

88.0 |

3.6 |

0.6 | ||||||

|

RDUG012 |

334642.0 |

1805642.7 |

428.8 |

45.3 |

2.0 |

29.0 |

170.0 |

141.0 |

1.7 |

0.4 |

|

RDUG013 |

334571.3 |

1805608.9 |

416.0 |

26.0 |

-46.0 |

49.0 |

86.0 |

25.0 |

1.2 |

0.3 |

|

102.0 |

116.6 |

10.0 |

1.3 |

0.2 | ||||||

|

220.0 |

326.0 |

122.0 |

1.6 |

0.5 | ||||||

|

RDUG018 |

334640.0 |

1805669.5 |

430.0 |

39.0 |

7.0 |

14.0 |

122.0 |

107.0 |

2.2 |

0.4 |

|

RDUG019 |

334639.9 |

1805669.4 |

429.6 |

46.3 |

-3.0 |

6.0 |

16.0 |

10.0 |

2.0 |

0.2 |

|

43.0 |

134.0 |

91.0 |

2.7 |

0.5 | ||||||

|

RDUG020 |

334640.0 |

1805669.5 |

429.1 |

45.7 |

-15.8 |

0.0 |

14.0 |

13.0 |

1.3 |

0.2 |

|

43.0 |

131.0 |

85.0 |

3.2 |

0.5 | ||||||

|

RDUG021 |

334639.9 |

1805669.5 |

428.7 |

48.0 |

-28.0 |

1.2 |

29.0 |

25.0 |

1.9 |

0.2 |

|

46.0 |

59.0 |

11.0 |

1.3 |

0.2 | ||||||

|

84.0 |

144.0 |

53.0 |

5.8 |

0.7 | ||||||

|

RDUG022 |

334571.5 |

1805607.7 |

415.8 |

46.4 |

-53.1 |

290.5 |

309.0 |

11.0 |

2.1 |

0.4 |

|

RDUG025 |

334684.1 |

1805601.3 |

427.3 |

44.0 |

-2.2 |

43.7 |

194.2 |

150.0 |

1.9 |

0.5 |

|

RDUG027 |

334647.8 |

1805648.9 |

398.5 |

47.1 |

-29.7 |

82.5 |

190.0 |

92.0 |

3.6 |

0.5 |

|

RDUG028 |

334647.8 |

1805648.8 |

399.2 |

47.7 |

-21.1 |

27.0 |

38.0 |

10.0 |

0.9 |

0.1 |

|

74.0 |

156.0 |

77.0 |

3.5 |

0.5 | ||||||

|

# Coordinates and Azimuth in Mine Grid and reported as whole numbers. |

|

* Results are length weighted and reported above 1g/t EqAu cut-off based on US$1250/oz gold and US$2.50/lb copper and composited to a minimum 10 metres true width including a maximum contiguous true width of sub-grade mineralization and rounded to one decimal place. EqAu g/t = Au g/t + (Cu% x 1.3714). |

|

^ Approximate True Width reported as whole numbers. |

|

Results are reported for completed holes that traverse the full width of mineralisation. |

Argentina

La Curva Joint Venture

On May 18 2017, the Company signed a definitive exploration and option agreement with Mirasol Resources (TSX-V:MRZ) to explore their 100% owned, La Curva gold project, located in Santa Cruz Province, Argentina. The La Curva Agreement grants the Company the option to acquire, in five stages, up to a 75% interest in the project with a first-year exploration commitment of $1.25 million including the completion of 3,000 metres of drilling and a $100,000 option payment to Mirasol on signing the Agreement.

La Curva is a 36,100 hectare exploration-stage gold project located at low elevation in an area with favourable infrastructure. Mirasol's historic exploration has outlined three gold prospects along a six-km long "La Castora" gold trend, which represent compelling drill targets for high-grade, low sulphidation epithermal gold and silver mineralization similar to that being mined at the Company's Waihi operation in New Zealand.

Targets are being finalised for a 3,000-metre diamond drill program that will commence as weather permits along the La Curva Castro gold trend in addition to the evaluation of additional targets in the Curva West area.

Other

All drill data can also be found on the Company's website at http://www.oceanagold.com/investor-centre/filings/

About OceanaGold

OceanaGold Corporation is a mid-tier, high-margin, multinational gold producer with assets located in the Philippines, New Zealand and the United States. The Company's assets encompass its flagship operation, the Didipio Gold-Copper Mine located on the island of Luzon in the Philippines. On the North Island of New Zealand, the Company operates the high-grade Waihi Gold Mine while on the South Island of New Zealand, the Company operates the largest gold mine in the country at the Macraes Goldfield which is made up of a series of open pit mines and the Frasers underground mine. In the United States, the Company is currently commissioning the Haile Gold Mine, a top-tier asset located in South Carolina. OceanaGold also has a significant pipeline of organic growth and exploration opportunities in the Americas and Asia-Pacific regions.

OceanaGold has operated sustainably over the past 27 years with a proven track-record for environmental management and community and social engagement. The Company has a strong social license to operate and works collaboratively with its valued stakeholders to identify and invest in social programs that are designed to build capacity and not dependency.

In 2017, the Company expects to produce 550,000 to 600,000 ounces of gold and 18,000 to 19,000 tonnes of copper with sector leading All-In Sustaining Costs that range from $600 to $650 per ounce sold.

Competent/Qualified Person's Statement

The resources and exploration results were prepared in accordance with the standards set out in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' ("JORC Code") and in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101"). The JORC Code is the accepted reporting standard for the Australian Stock Exchange Limited ("ASX").

Information relating to Haile exploration results in this document has been verified by, is based and fairly represents information compiled by or prepared under the supervision of Jonathan Moore, a Member and Chartered Professional with the Australian Institute of Mining and Metallurgy and an employee of OceanaGold. Information relating to Waihi exploration results in this document has been verified by, is based on and fairly represents information compiled by or prepared under the supervision of Lorrance Torckler, a Fellow of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Information relating to Macraes exploration results in this document has been verified by Sean Doyle, a Chartered Professional with the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold J. Moore, L. Torckler and S. Doyle have sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code and all are Qualified Persons for the purposes of the NI 43 101. Messrs Moore, Torckler and Doyle consent to the inclusion in this public report of the matters based on their information in the form and context in which it appears.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed "forward-looking" within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company's expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company's most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company's name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

SOURCE OceanaGold Corporation