/NOT FOR PUBLICATION OR DISTRIBUTION IN THE UNITED STATES, JAPAN OR AUSTRALIA/

VANCOUVER, BC, Feb. 2, 2024 /CNW/ - OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) ("OceanaGold" or the "Company") is pleased to announce that its wholly owned subsidiary, OceanaGold Philippines, Inc. ("OGPI"), has filed a registration statement and draft preliminary prospectus with the Philippine Securities and Exchange Commission ("SEC") and a listing application with The Philippine Stock Exchange, Inc. ("PSE") in relation to the proposed initial public offering (the "Offering") of 20% of the outstanding common shares of OGPI. OGPI holds the Company's interest in the Didipio Mine and, pursuant to the terms of the renewed Financial or Technical Assistance Agreement ("FTAA"), is required to list its common shares on the PSE. The Offering is a secondary offering of common shares, with the proceeds to be received by a wholly owned subsidiary of OceanaGold.

OceanaGold is also providing an update on the recently completed Didipio underground optimization work (the "Underground Optimization"), the year-end 2023 Mineral Reserves and Mineral Resources estimate for Didipio, and recent exploration and resource conversion results at Didipio.

Gerard Bond, President and CEO of OceanaGold, said, "We are proud of Didipio's track record as a proven high-quality, long-life, low-cost gold-copper mine and look forward to welcoming new Filipino and international shareholders to participate in the expected robust free cash flow generation, consistent dividend payments, and future potential at Didipio.

Today's release highlights the upside potential we see at Didipio, including findings from the Underground Optimization work and further exploration and resource conversion success as we look to replace and add additional reserves and resources. We believe that the future at Didipio is bright and look forward to it continuing to create value for both OceanaGold and our new OGPI shareholders."

OGPI has filed a registration statement and draft preliminary prospectus with the SEC for the Offering of 20% of OGPI's common shares, with the Offering expected to be completed prior to July 2024. OGPI holds the Company's interest in the Didipio Mine and, pursuant to the terms of the renewed FTAA, is required to list at least 10% of its common shares on the PSE. Due to the PSE's minimum public float requirement of 20%, OGPI intends to list all of its issued and outstanding common shares and publicly float 20% thereof on the main board of the PSE.

The Offering, which is subject to receipt of Philippine regulatory approvals, operating performance and market conditions, will comprise a secondary offering of common shares of OGPI, with the proceeds to be received by a wholly owned subsidiary of OceanaGold. The proposed Offering price will be determined in the context of the market through a book building process with a maximum up-to price of ₱17.28 per share (US$0.31 per share), and a maximum sale of 456,000,000 common shares. The Offering is being led by BDO Capital & Investment Corporation as Global Coordinator and Domestic Underwriter and Bookrunner, with CLSA Limited as International Underwriter.

To comply with Philippine regulatory requirements, the draft preliminary prospectus, which contains important information in relation to the Offering, and accompanying Philippine Mineral Reporting Code technical report with respect to the Didipio Mine, have been made available to Philippine residents on https://www.didipiomine.com.ph/. The Company notes that its technical report titled "NI 43-101 Technical Report Didipio Gold/Copper Operations Luzon Island, Philippines" dated March 31, 2022 with an effective date of December 31, 2021 (the "Didipio Technical Report"), which is available on SEDAR+ at www.sedarplus.com and the Company's website, remains the Company's current technical report for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The Underground Optimization work assessed the potential for increased underground mining rates, as well as potential resource extensions below the current reserve limit of Panel 2 (2100 mRL). Preliminary findings include:

- The potential to increase total underground material movement to approximately 2.5Mtpa (from the current 1.75Mtpa), displacing lower grade stockpile ore and thereby increasing the overall feed grade to the mill;

- The potential to increase mill throughput from the current 4.0Mtpa to the already permitted 4.3Mtpa to maximize the benefit of processing the larger volume of higher-grade underground ore;

- The potential to extend mine life and increase gold and copper production through further resource conversion drilling and extension drilling in Panels 3 and 4 and below;

- Estimated additional life-of-mine growth capital of between US$100 million and US$130 million for additional mine development, expansion of the mobile equipment fleet, paste fill plant upgrade, dewatering and ventilation; and

- The potential to generate a strong return on this growth capital through increased gold and copper production and extended mine life.

There is no certainty, nor can OceanaGold provide any assurance, that the results of the Underground Optimization will be realized, in part or at all. The findings of the work will require further assessment and analysis, including further resource extension and conversion drilling, and the Company intends to complete this work with the target to publish a NI 43-101 technical report in the first half of 2025, which is expected to include:

- Detailed mine planning and trade off analysis of higher underground production rates and optimal cut-off grade to support the increased underground material movement target;

- Detailed design and cost estimates for increased mobile equipment, paste plant, ventilation, and dewatering infrastructure;

- A power demand study for additional underground infrastructure, and an analysis of potential equipment electrification to meet carbon reduction commitments;

- Detailed definition of the implementation plan to deliver the projected operational availability and utilization improvements underpinning the increased production; and

- An updated Mineral Resource estimate to include the results of new drilling intended to extend and increase confidence in the Mineral Resources in Panel 3 and Panel 4 below the current reserves level (~2100 mRL).

The Proven and Probable Mineral Reserves estimates at December 31, 2023 at Didipio are presented in Table 1 below. The year-over-year 0.08 Moz decrease in Mineral Reserves was due to 2023 mining depletion, partially offset by conversion of underground resources.

Total open pit stockpiles at Didipio are comprised of Proven Mineral Reserves of 12.7 Mt at 0.38 g/t Au and 0.35% Cu (mined to a 0.4 g/t AuEq cut-off) with an additional stockpile of 5.3Mt at 0.18 g/t Au and 0.15% Cu (mined to an approximate 0.27g/t AuEq cut-off).

Table 1: Didipio Mineral Reserves for Year-End 2023

|

RESERVES |

PROVEN |

PROBABLE |

PROVEN & PROBABLE |

|||||||||||||

|

Mt |

Au g/t |

Ag g/t |

Cu % |

Mt |

Au g/t |

Ag g/t |

Cu % |

Mt |

Au g/t |

Ag g/t |

Cu % |

Au Moz |

Ag Moz |

Cu Mt |

Cut-Off |

|

|

Open Pit Stockpiles |

18.0 |

0.32 |

2.0 |

0.29 |

. |

. |

. |

. |

18.0 |

0.32 |

2.0 |

0.29 |

0.18 |

1.2 |

0.05 |

0.40 g/t AuEq |

|

Underground |

14.6 |

1.56 |

1.9 |

0.43 |

5.9 |

0.95 |

1.6 |

0.36 |

20.5 |

1.38 |

1.8 |

0.41 |

0.91 |

1.2 |

0.08 |

0.76 g/t & 1.16 g/t AuEq |

|

DIDIPIO TOTAL |

32.6 |

0.87 |

1.9 |

0.35 |

5.9 |

0.95 |

1.6 |

0.36 |

38.6 |

0.88 |

1.9 |

0.35 |

1.10 |

2.3 |

0.14 |

|

- Mineral Reserves defined by mine designs based upon metal prices of US$1,500/oz gold, US$3.00/lb copper and US$17/oz silver.

- Reported estimates of contained metal are not depleted for processing losses. Cut-offs are applied to diluted grades.

- Incremental stopes proximal to development already planned to access main stoping areas are reported at a lower cut-off of 0.76g/t AuEq, where AuEq = Au g/t + 1.38 x Cu%.

The Measured, Indicated and Inferred Mineral Resources (inclusive of Mineral Reserves) estimates at December 31, 2023 at Didipio are presented in Table 2 below. The year-over-year 0.11 Moz increase in Mineral Resources was due to 0.27 Moz of resource growth in the underground due to successful resource conversion and extensional drilling, partially offset by 2023 mining depletion of 0.16 Moz.

|

RESOURCES |

MEASURED |

INDICATED |

MEASURED & INDICATED |

|||||||||||||

|

Mt |

Au g/t |

Ag g/t |

Cu % |

Mt |

Au g/t |

Ag g/t |

Cu % |

Mt |

Au g/t |

Ag g/t |

Cu % |

Au Moz |

Ag Moz |

Cu Mt |

Cut-Off |

|

|

Open Pit Stockpiles |

18.0 |

0.32 |

2.0 |

0.29 |

. |

. |

. |

. |

18.0 |

0.32 |

2.0 |

0.29 |

0.19 |

1.2 |

0.05 |

0.40 g/t AuEq |

|

Underground |

15.0 |

1.70 |

2.1 |

0.46 |

14.8 |

0.92 |

1.5 |

0.34 |

29.8 |

1.31 |

1.8 |

0.40 |

1.26 |

1.7 |

0.12 |

0.67 g/t AuEq |

|

DIDIPIO TOTAL |

33.0 |

0.95 |

2.0 |

0.37 |

14.8 |

0.92 |

1.5 |

0.34 |

47.8 |

0.94 |

1.9 |

0.36 |

1.44 |

2.9 |

0.17 |

|

|

INFERRED |

||||||||||||||||

|

Mt |

Au g/t |

Ag g/t |

Cu % |

Au Moz |

Ag Moz |

Cu Mt |

Cut-Off |

|||||||||

|

Underground |

12 |

0.8 |

1.3 |

0.3 |

0.30 |

0.5 |

0.03 |

0.67 g/t AuEq |

||||||||

|

DIDIPIO TOTAL |

12 |

0.8 |

1.3 |

0.3 |

0.30 |

0.5 |

0.03 |

|||||||||

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration.

- Underground Mineral Resources estimate is reported within optimised stope designs, above 1,800mRL, based upon metal prices of US$1,700/oz gold, US$350/lb copper and US$20/oz silver.

- Underground Mineral Resources are estimated at 0.67 g/t AuEq cut off, where AuEq = Au g/t + 1.39 x Cu%.

- Open pit stockpiles include 5.3 Mt of low grade at 0.27 g/t AuEq cut-off.

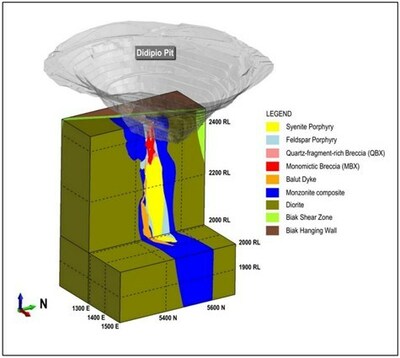

The Didipio alkalic Cu-Au porphyry deposit comprises a series of mineralised intrusions (monzonite, monzonite porphyry, pegmatite (Balut) dyke, feldspar porphyry, syenite porphyry) and associated quartz and monomictic breccias within a diorite stock (Figure 1).

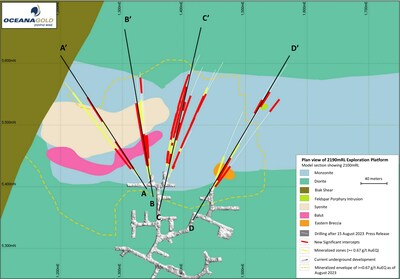

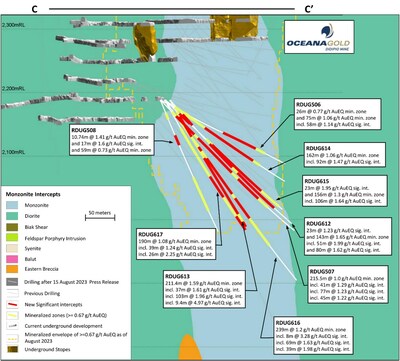

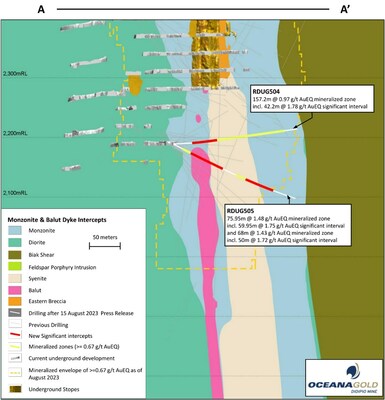

Since the Company's news release dated August 15, 2023, 5,343 meters ("m") of resource conversion and extensional drilling in twenty-two holes has been completed from underground (Figure 2).

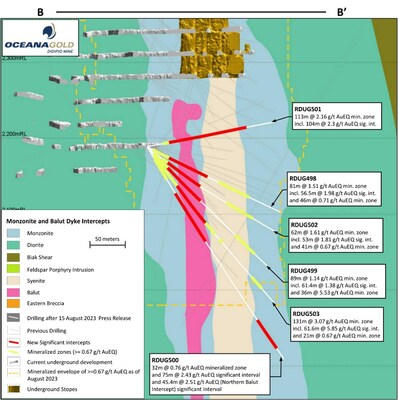

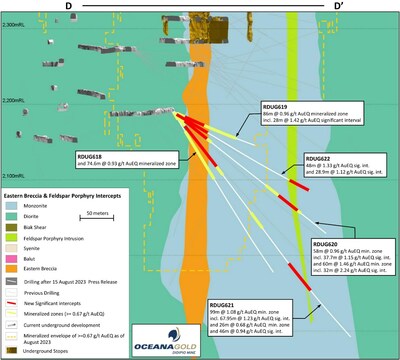

Resource extensional drilling in H2 2023 focused on: testing for the Balut Dyke on the northern side of the Syenite Porphyry (Figure 3) and following up on the success of the late-2022 drilling which discovered the mineralized Eastern Breccia and Feldspar Porphyry in the east (Figure 4).

Testing of the Balut Dyke below 1980mRL and to the north of the Syenite Porphyry has returned a positive result intersecting disseminated and clots of chalcopyrite and bornite in an actinolite pegmatite returning 45.4m @ 2.51g/t AuEq in RDUG500; a similar thickness and grade to previous intercepts of the Balut Dyke south of the Syenite Porphyry and at higher elevations (Figure 3). Mineralization of the newly discovered pegmatite remains open along strike and at depth while its analogue on the south remains open at depth.

Two additional mineralized intrusives to the east were discovered in 2022 (Eastern Breccia and Feldspar Porphyry) and were further tested during the H2 2023 drilling program (Figure 4). The Eastern Breccia, an intrusive breccia with monzonite and diorite clasts, contains a significant amount of Cu-Au mineralization which occurs as fine dissemination and sulphide veins within an intensely altered potassic zone. The Eastern Breccia remains unexplored below 2000mRL. Mineralization in the other mineralized intrusive, the Feldspar Porphyry Intrusion, has been extended a further 100m vertically.

Resource conversion drilling in H2 2023 focused on conversion of the Inferred Mineral Resources within the Monzonite Porphyry directly east of the Syenite Porphyry within Panel 2 (>2100mRL) and Panel 3 (< 2100mRL, Figure 5) and conversion of Inferred material within the Balut Dyke to the south of the Syenite Porphyry (Figure 4 and Figure 6).

Drilling has converted 0.27 Moz of Inferred Mineral Resources to Indicated Mineral Resources within the Monzonite Porphyry and Balut Dyke, providing improved confidence within Panel 3 between ~2100mRL and 2000mRL, and demonstrating continuity of relatively high-grade porphyry Cu-Au mineralization within the Monzonite Porphyry east of the Syenite Porphyry (Figure 5).

A 28,000 m program of resource conversion and expansion drilling is planned at Didipio underground in 2024. Resource conversion drilling will focus on infilling Panel 3 to convert existing inferred resources, while expansion drilling will test below 1930mRL (Panel 4), down-dip of existing mineralization.

Regional exploration in 2024 includes (i) advancing the Napartan target, 9km north-west of the Didipio mine with surface mapping and sampling followed by Initial drilling of a Cu-Au mineralised pegmatite target similar in nature to the Balut Dyke mined at Didipio, (ii) advancing the Cabanwingan targets on approval of the exploration tenement application, and (iii) continued regional targeting within the Company's FTAA permit.

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Cu (%) |

AuEq (g/t) |

Target |

Category |

|

RDUG498 |

29.5 |

86 |

56.5 |

1.41 |

0.41 |

1.98 |

S. Monzonite, S. |

Conversion |

|

RDUG499 |

36.4 |

97.8 |

61.4 |

0.98 |

0.29 |

1.38 |

S. Monzonite, S. |

Conversion |

|

RDUG500 |

70 |

145 |

75 |

1.71 |

0.52 |

2.43 |

S. Monzonite, S. |

Conversion |

|

and |

269 |

314.4 |

45.4 |

1.95 |

0.4 |

2.51 |

N. Balut ext. |

Extensional |

|

RDUG501 |

28 |

132 |

104 |

1.81 |

0.35 |

2.3 |

S. Monzonite, S. |

Conversion |

|

RDUG502 |

32 |

85 |

53 |

1.32 |

0.35 |

1.81 |

S. Monzonite, S. |

Conversion |

|

RDUG503 |

63 |

124.6 |

61.6 |

4.48 |

0.98 |

5.85 |

S. Monzonite, Balut |

Conversion |

|

RDUG504 |

29.8 |

72 |

42.2 |

1.17 |

0.44 |

1.78 |

S. Balut Extension, S. |

Conversion |

|

RDUG505 |

31 |

90.95 |

59.95 |

1.23 |

0.37 |

1.75 |

S. Balut Extension, |

Conversion |

|

and |

133 |

183 |

50 |

1.18 |

0.39 |

1.72 |

Syenite, N. |

Conversion |

|

RDUG506 |

111 |

169 |

58 |

0.7 |

0.32 |

1.14 |

Eastern Monzonite |

Conversion |

|

RDUG507 |

34 |

75 |

41 |

0.75 |

0.39 |

1.29 |

Eastern Monzonite |

Conversion |

|

and |

83 |

160 |

77 |

0.76 |

0.34 |

1.23 |

Eastern Monzonite |

Conversion |

|

and |

174 |

219 |

45 |

0.76 |

0.33 |

1.22 |

Eastern Monzonite |

Conversion |

|

RDUG508 |

59 |

76 |

17 |

1.08 |

0.38 |

1.6 |

Eastern Monzonite |

Conversion |

|

RDUG612 |

29 |

52 |

23 |

0.66 |

0.41 |

1.23 |

S. Monzonite |

Conversion |

|

and |

92 |

143 |

51 |

1.4 |

0.42 |

1.99 |

S. Monzonite |

Conversion |

|

including |

133 |

143 |

10 |

2.79 |

0.55 |

3.55 |

S. Monzonite |

Conversion |

|

and |

155 |

235 |

80 |

1.08 |

0.39 |

1.62 |

N. Monzonite |

Conversion |

|

RDUG613 |

29 |

66 |

37 |

0.89 |

0.52 |

1.61 |

S. Monzonite, S. |

Conversion |

|

and |

105 |

208 |

103 |

1.48 |

0.35 |

1.96 |

S. Monzonite |

Conversion |

|

including |

164 |

176 |

12 |

3.95 |

0.57 |

4.74 |

S. Monzonite |

Conversion |

|

and |

222 |

231.4 |

9.4 |

3.64 |

0.96 |

4.97 |

N. Monzonite |

Conversion |

|

RDUG614 |

75 |

167 |

92 |

0.87 |

0.44 |

1.47 |

S. Monzonite and N. |

Conversion |

|

RDUG615 |

30 |

53 |

23 |

1.08 |

0.63 |

1.95 |

S. Monzonite |

Conversion |

|

and |

101 |

207 |

106 |

1.05 |

0.43 |

1.64 |

S. Monzonite and N. |

Conversion |

|

RDUG616 |

90 |

98 |

8 |

1 |

1.64 |

3.28 |

S. Monzonite |

Conversion |

|

and |

112 |

181 |

69 |

1.16 |

0.33 |

1.63 |

S. Monzonite |

Conversion |

|

and |

189 |

228 |

39 |

1.52 |

0.34 |

1.98 |

N. Monzonite |

Conversion |

|

RDUG617 |

139 |

178 |

39 |

0.99 |

0.18 |

1.24 |

S. Monzonite |

Conversion |

|

and |

214 |

240 |

26 |

1.68 |

0.41 |

2.25 |

N. Monzonite |

Conversion |

|

RDUG619 |

15 |

43 |

28 |

0.71 |

0.51 |

1.42 |

E. Monzonite |

Conversion |

|

RDUG620 |

18.3 |

56 |

37.7 |

0.63 |

0.37 |

1.15 |

E. Monzonite |

Conversion |

|

and |

177 |

209 |

32 |

1.39 |

0.61 |

2.24 |

Feldspar Porphyry |

Extensional |

|

RDUG621 |

23 |

90.95 |

67.95 |

0.64 |

0.42 |

1.23 |

Eastern Breccia |

Conversion |

|

and |

251 |

297 |

46 |

0.5 |

0.31 |

0.94 |

Feldspar Porphyry |

Extensional |

|

RDUG622 |

5 |

53 |

48 |

0.68 |

0.47 |

1.33 |

Eastern Breccia |

Conversion |

|

and |

179 |

207.9 |

28.9 |

0.57 |

0.4 |

1.12 |

Feldspar Porphyry |

Extensional |

For further information relating to drill hole data, please refer to the Company's website at https://oceanagold.com/investor-centre/tsx-asx-filings.

OceanaGold is a growing intermediate gold and copper producer committed to safely and responsibly maximizing the generation of Free Cash Flow from our operations and delivering strong returns for our shareholders. We have a portfolio of four operating mines: the Haile Gold Mine in the United States of America; Didipio Mine in the Philippines; and the Macraes and Waihi operations in New Zealand.

All Mineral Reserves and Mineral Resources for the Didipio Mine were estimated as at December 31, 2023 and have been prepared in accordance with NI 43-101.

The Mineral Resources estimate for Didipio has been verified and approved by, or is based on information prepared by, or under the supervision of, J. Moore, the Company's Group Manager – Resource Development, while the Mineral Reserves estimate for Didipio has been verified and approved by, or is based upon information prepared by, or under the supervision of, P. Jones, the Company's Group Mining Engineer - Underground. Each of Messrs. Moore and Jones is a qualified person under NI 43-101.

For further scientific and technical information supporting the disclosure in this news release (including disclosure regarding Mineral Resources and Mineral Reserves, data verification, key assumptions, parameters, methods used to estimate the Mineral Resources and Mineral Reserves, and risks and other factors), please refer to the Didipio Technical Report, which is available on SEDAR+ at www.sedarplus.com and on the Company's website.

Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration.

The scientific and technical information contained in this news release relating to the Underground Optimization has been reviewed and approved by P. Jones, a qualified person under NI 43-101. Mr. Jones is the Company's Group Mining Engineer - Underground.

The scientific and technical information contained in this news release relating to Didipio exploration results has been reviewed and approved by Craig Feebrey, a Member of the Australasian Institute of Mining and Metallurgy and qualified person under NI 43-101. Mr. Feebrey is the Company's Chief Exploration Officer.

Exploration diamond core samples at the Didipio Mine are typically drilled with HQ core barrel equipment. The HQ samples are then cut, with half of the core retained at the secure core shed facility on site to which access is controlled. In cases where OceanaGold has collected metallurgical samples, a further quarter of the core has been taken with only one-quarter core retained. Following core cutting, the half-core sample is submitted for analysis.

Since 2013, all OceanaGold samples have been processed on-site at a laboratory facility operated by SGS Philippines Inc ("SGS"). SGS is independent from OceanaGold. After dispatching to SGS, samples are dried at 105 degrees C for 8 to 12 hours, allowed to cool, and then weighed. Within the sample assay workflow, the SGS lab randomly inserts laboratory duplicate and replicate samples as well as certified reference materials ("CRM") for quality control ("QC") monitoring. Samples are crushed to produce 500g to 1000g of material for the primary analysis and any lab duplicates. The remaining coarse reject material is retained during the assay process. The sample (and any lab duplicates) are then pulverized to 75% passing 2mm, followed by a subsequent pulverizing to 85% passing 75um. The primary sample is then split down to 200g (with an additional 200g for replicate sampling when applicable). A scoop of 30g is then taken from the 200g sample with the remaining pulp retained.

Gold analysis is by Fire Assay with AAS finish. Copper analysis is either by AAS on a 3-acid digest or XRF. These methods are considered appropriate for the type of mineralisation and expected grade tenor. The quantity and quality of the lithological, geotechnical, and geochemical data collected in the exploration, surface resource delineation, underground resource delineation, and grade control drill programs are considered sufficient to support the Mineral Resources and Mineral Reserves estimation.

In addition to the internal SGS QC controls, OceanaGold also monitors laboratory performance with the following processes:

- Inserting duplicate samples;

- Inserting CRM blanks and coarse blanks;

- Inserting CRM standards for Au, Cu, Ag; and

- Monthly monitoring of SGS duplicate, replicate, and CRM performance.

SGS is currently certified to ISO 9001, 14001, and 45001. The ISO 17025:2017 accreditation preparation of SGS - Didipio Laboratory is ongoing as SGS works through the reaccreditation process with the Philippines Accreditation Bureau. Whilst this process is being undertaken, SGS – Didipio Laboratory has ensured its operation is aligned with the ISO 17025:2017 standards as supported by the satisfactory results of the 2023 audit conducted by the SGS internal auditors. All the results included in this summary were validated through the independent QC monitoring by both the SGS - Didipio Laboratory and OceanaGold with the insertion of duplicate, replicate, and blank samples, as well as CRM with no issues noted.

Certain information contained in this news release may be deemed "forward-looking" within the meaning of applicable securities laws. All statements other than statements of historical facts included in this news release constitute forward-looking statements, including but not limited to, the terms and details of the Offering, completion of the Offering, the findings of the Underground Optimization work, the preparation for an updated NI 43-101 on the Didipio Mine and the scope of such technical report, information relating to future performance and reflect the Company's expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of the Company and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and are forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of Mineral Reserve and Mineral Resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company's most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR+ at www.sedarplus.com under the Company's name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as at the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this news release are based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws.

THIS DOCUMENT IS NOT AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ELSEWHERE. THE SECURITIES OF OGPI ARE NOT BEING REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT") AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES UNLESS REGISTERED UNDER THE SECURITIES ACT OR PURSUANT TO AN EXEMPTION FROM SUCH REGISTRATION. THERE WILL BE NO PUBLIC OFFERING OF THE SECURITIES OF OGPI IN THE UNITED STATES. NO MONEY, SECURITIES OR OTHER CONSIDERATION IS BEING SOLICITED BY THIS NEWS RELEASE OR THE INFORMATION CONTAINED HEREIN AND, IF SENT IN RESPONSE TO THIS DOCUMENT OR THE INFORMATION CONTAINED HEREIN, WILL NOT BE ACCEPTED.

A REGISTRATION STATEMENT RELATING TO OGPI'S SHARES HAS BEEN FILED WITH THE PHILIPPINE SECURITIES AND EXCHANGE COMMISSION, BUT HAS NOT YET BECOME EFFECTIVE. THESE SHARES MAY NOT BE SOLD NOR OFFERS TO BUY THEM BE ACCEPTED PRIOR TO THE TIME THE REGISTRATION STATEMENT IS RENDERED EFFECTIVE. THIS COMMUNICATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR BE CONSIDERED A SOLICITATION TO BUY.

SOURCE OceanaGold Corporation